“Heading into 2020, very low home finance loan rates plus the improving upon economic system would be the important motorists on the housing sector with continuous increases in house gross sales, design, and residential selling prices,” Khater stated.

The shock due to the sudden boost in curiosity premiums about the morning of September 17, which may have led lenders to halt their lending until eventually they might Obtain far more details about the marketplace conditions[fifty five]

Some economists have acknowledged that liquidity rules can have prevented banking companies from lending a lot more money to the repo marketplaces in September 2019, As a result contributing towards the hard cash scarcity.[fifty one][e] Other researchers have taken a different look at. They have got argued that the inability of banks to deploy liquidity promptly to benefit from the significant rates wasn't because of the liquidity restrictions by themselves, but by the more prudent risk-administration framework place set up by banking companies after the 2007-08 crisis.

Control daily price alterations. However, if you have a very good mortgage charge estimate now, don’t be reluctant to lock it in.

The frequency of federal pupil loan defaults was calculated for and released Within this 2020 SBPC Examination. The Examination merged Every single of the quarterly 2019 new Direct Loan defaults posted with the U.

“Specialist verified” ensures that our Economic Evaluation Board totally evaluated the write-up for accuracy and clarity. The Assessment Board comprises a panel of financial authorities whose aim is making sure that our written content is usually objective and well balanced.

In general, a borrower with the next credit score score, stable money and a sizable deposit qualifies for the bottom costs.

Household fairness loans Home fairness loans Enable you to borrow a lump sum at a set amount, based on the amount of of the house you individual outright.

When mortgage rates are around the upswing, it'd make fewer financial perception to test to refinance. Normally, it’s very best to refinance if you can shave off just one-half to a few-quarters of the percentage point from a current fascination rate, and if you intend to remain in your house for an extended interval. If you plan to offer your property before long, the Expense to refinance might not be worth it.

Property finance loan fees as time passes Home finance loan amount predictions How historic house loan fees influence purchasing a household How historical mortgage rates impact refinancing Back again to major

Comprehension mortgage fees historical past aids body present problems and shows how nowadays’s rates compare into the historic mortgage premiums averages. Right here’s how normal thirty-calendar year charges have transformed from year to calendar year in the last 5 a long time.

For a borrower, it doesn’t make Considerably perception to try to time your charge With this marketplace. Our greatest suggestions is to purchase any time website you’re financially All set and can pay for the house you need — regardless of present-day curiosity premiums.

Take into account that you’re not stuck using your home loan charge eternally. If premiums drop substantially, homeowners can always refinance in a while to chop expenses.

All of our content material is authored by really competent experts and edited by material experts, who guarantee all the things we publish is aim, exact and trustworthy. Our home finance loan reporters and editors concentrate on the points customers treatment about most — the newest premiums, the most beneficial lenders, navigating the homebuying system, refinancing your home loan plus much more — so you're able to really feel confident after you make decisions as being a homebuyer in addition to a homeowner.

To understand today’s mortgage loan fees in context, Have a look at exactly where they’ve been all through background.

four % by 2009. At this time, the Federal Reserve carried out quantitative easing measures, obtaining mortgage loan bonds in bulk to generate down desire charges and usher in an financial recovery.

Danny Tamberelli Then & Now!

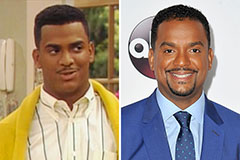

Danny Tamberelli Then & Now! Alfonso Ribeiro Then & Now!

Alfonso Ribeiro Then & Now! Tiffany Trump Then & Now!

Tiffany Trump Then & Now! Robbie Rist Then & Now!

Robbie Rist Then & Now! Melissa Sue Anderson Then & Now!

Melissa Sue Anderson Then & Now!